Who Is Dirt Legal Title?

Is Dirt Legal Title Legit?

What are the reviews for Dirt Legal Title?

Owner

The ownership is listed as “Brandon Marc Smithline”, of Florida. (click image for larger picture)

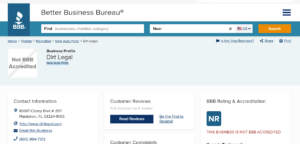

Does not have BBB Accreditation

Background

There is a criminal record for a “Brandon Marc Smithline” in Florida for Grand Theft Auto Felony and “Dealing in Stolen Property”.

Is this the same “Brandon Marc Smithline’? Is this related to car title paperwork?(click image for larger picture)

There is also a “Street Legal LLC” in MT with the name, is that a shell corporation out of state?

Dirt Legal Title Reviews

Crackdown On Car Owners Dodging Taxes With Montana Registration

The state of Minnesota is cracking down on a high-end motor vehicle scheme that originates in Montana, and has cheated the state out of at least $1 million in taxes. “This is illegal. It’s tax evasion,” said Lt. Tiffani Scheigert of the Minnesota State Patrol. “These individuals are evading taxes because by registering in Montana, they are avoiding sales tax there, and yet they are operating the vehicles here in Minnesota as a Minnesota resident.” But if you ignore it, there are criminal charges and possible jail time.

The Ramsey County Attorney’s Office charged a St. Paul man in 2014 with tax evasion for buying two cars — a $48,249 Land Rover and a $67,995 Porsche 9911 Carrera 4.

The court complaint said he registered both vehicles under a fake business name in Montana to avoid $7,490 in taxes.

Georgia is Cracking Down on Instagram Bros Registering Supercars in Montana to Avoid Taxes

Waites begins by saying that he and his fellow officers have known about the “Montana scheme” for years, and that their goal with this whole investigation was to put an end to it in their state. Georgia has been tracking folks engaging in the scheme, saying his team worked with the state of Montana, and was able to get the names of the corporate officers of the small LLCs set up in the state, as well as the names of the LLCs themselves. With that, they could learn if those names matched up with Georgia residents.

Waites also says he’s gotten pictures from folks who attend local car shows of exotics with Montana plates, and he says his team has worked with the toll authority to get a list of all Montana-registered cars that have a Peach Pass—a little transponder on the windshield that allows for digital toll collection.

The Pitfalls Of The Montana License Plate Scam

The scam works like this: You hire a Montana law firm to form a corporation or limited liability company (LLC) for you. You own the LLC outright. Your exotic or expensive car or RV is purchased by your LLC. The LLC registers and plates the vehicle in Montana. As the attorney in this relationship, I have to be the one to tell you the bad news, and it’s twofold bad news. As noted, this maneuver is probably illegal in your state. Even though the company is a sham set up for the sole purpose of evading taxes. Do a quick Google search and see the various people who ended up being audited trying to defend this scheme.

Shelby County Resident Pleads “No Contest” to Attempted Tax Evasion

DeStefanis, who was previously indicted by a Wilson County Grand Jury for tax evasion, violated Tennessee law by failing to pay sales tax on vehicles purchased by his Montana LLC, and signing a sworn affidavit that the vehicles would be removed from the state within three days of purchase.

South Dakota Has Made Millions From Out-of-State Car Registrations

State law prohibits registering your vehicle out of state

CVC §8804 – Every person who, while a resident, as defined in Section 516, of this state, with respect to any vehicle owned by him and operated in this state, registers or renews the registration for the vehicle in a foreign jurisdiction, without the payment of appropriate fees and taxes to this state, is guilty of a misdemeanor.

Owners with Montana plates accused of cheating local taxpayers

The Georgia Department of Revenue Special Investigations Unit, leading up to local raids that also involved the Federal Aviation Administration, Sandy Springs Police Department and Cobb County Police Department.

Authorities executed search warrants for an investigation focused on two men accused of registering numerous exotic cars in Montana because the state does not charge sales tax or ad valorem tax on cars, unlike Georgia and most other states.

Avoid Paying Taxes on Your New Car Is Risky Business

California but also Arizona, Colorado, Maryland, Massachusetts, Michigan, Nevada, Oregon, and Washington. Some have set up tip lines so that citizens can report suspected tax cheats. Last year, in fact, Californians reported 260 Montana plates to the CHiPs, who can say, “Please prove your established state of residency.” “False statements on your insurance application are grounds for denying a claim.”

Avoiding taxes and evading taxes are not conjoined twins, because one of them can put you in prison. If your state decrees that it has primary jurisdiction and that you’ve formed the Montana LLC for the sole purpose of evading taxes, you’ve evaded taxes. They’ll apply the legal test of “piercing the corporate veil.” Did you, in good faith, establish your LLC as a business to make a profit? If not, it may be judged a shell corporation. Go tell Judge Judy, but you’ll likely dole out more than the $15,000 you saved in the first place.